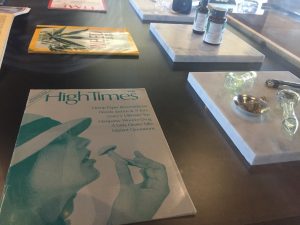

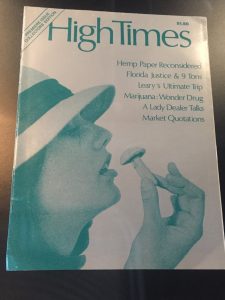

As cannabis shakes off the final grasps of prohibition, the emerging cannabis industry is poised to blast off. Forbes forecasts the North American cannabis industry going from $9.2 billion in 2017 to $47.3 billion by 2027. One of the most well-known industry leaders, High Times, is positioning themselves to take full advantage of this emerging trend.

As cannabis shakes off the final grasps of prohibition, the emerging cannabis industry is poised to blast off. Forbes forecasts the North American cannabis industry going from $9.2 billion in 2017 to $47.3 billion by 2027. One of the most well-known industry leaders, High Times, is positioning themselves to take full advantage of this emerging trend.

High Times Moving Away From the Counter Culture

In June 2018, High Times was acquired by a group of investors at a $70 million dollar valuation. The head of the investment group, Adam Levin, released his vision for High Times in the following statement. “We are going to build on the strong base they created to bring High Times from the authority in the counterculture movement to a modern media enterprise.”

Levin is making true on his promise of taking High Times from counter-culture to mainstream. A statement released on High Times reads:

“We’re making history by becoming one of the first cannabis-focused companies publicly traded on the Nasdaq.”

What’s An IPO?

When companies list their stock on the Nasdaq, the opening price they list the stock is called the Initial Public Offering or IPO for short. Levin hinted at High Times releasing their IPO* at $12.1.

High Times Crowdsourcing Campaign

Investors looking to get in early are in luck. High Times has started a crowdsourcing campaign where early investors will receive different incentives based on the size of their investment.

- $420 – Framed stock certificate

- $1100 – Limited edition High Times investor merch

- $5,000 – 10-year subscription to High Times

- $20,000 – Limited Edition Cannabis Cup investor trophy

- $50,000 – VIP Amsterdam Cannabis Cup Trip for 2

- $100,000 – LIFETIME Super VIP Cannabis Cup access

Americans have forgotten how vital cannabis and hemp have been to this great nation. Presidents have grown it, our constitution was signed on it. As cannabis continues to get legalized and go mainstream, so must the publications that provide a voice and face to our industry. For decades, High Times has been one of the most recognized voices of the cannabis community. We applaud and support their efforts to push our industry back into the mainstream.

![[Quick Review] Cordless Screwball – Vapvana Goes Wireless](https://420vapezone.com/wp-content/uploads/2024/06/cordless-screwball-main-400x250.webp)

![[News] 2 out of 50000+ Venty Vaporizers have Melted](https://420vapezone.com/wp-content/uploads/2024/03/melted-bowl2-375x250.jpg)

Take a beat. What you’re promoting here as “crowdsourcing” might be a disaster for individual investors.

I haven’t looked into this with any diligence, but here goes with my opinion (only).

It looks like a Reg A+ **private placement** of securities, not an IPO. That means, no ready, easy market to sell what you buy.

It might “potentially” might one day be traded on the NASDAQ if they sell enough shares.

But consider: “Only a handful of Reg A+ companies ever moved on to listing on a public exchange like NASDAQ or NYSE. Those that did, according to the same Barron’s article, saw their average stock price fall 40% in the six months following their listings, underperforming the otherwise flourishing bull market by nearly 50 percentage points. Why? Most priced themselves poorly from the start, lacking the expert guidance of investment banks who shun Reg A+ offerings. Others were just bad businesses.” https://www.google.com/search?q=regulation+A%2B+trading+nasdaq&ie=utf-8&oe=utf-8

Some have called Reg A+ offerings, dead as a route to publicly trading.

High Times tried to go public directly via filings beginning in January https://www.sec.gov/Archives/edgar/data/1714420/000121390018000900/fa12018_hightimeshold.htm#d_004 , which I think they had to pull after repeated problems with the Securities Exchange Commission.

They then tried to merge with a special purpose entity (just a “blind pool” with no business, holding cash) that was already trading on the NASDAQ, Origo Corp. Instant public trading! But Origo was delisted by the NASDAQ, so that fell through too. https://nypost.com/2018/06/21/high-times-plots-new-path-to-ipo/

The 2017 acquisition of High Times by the chairman’s holding company required the assumption of so much debt, they’re seemingly near drowning, and a shut down of the company is a possibility. https://seekingalpha.com/article/4142762-high-times-running-time

The level of distress is right there, some analysts say, in their public filing. https://www.newcannabisventures.com/high-times-financial-pressure-revealed-in-sec-filing/

I won’t be investing my money.